With the election just a couple of weeks away, the equity market continues to recover from its early to mid-September swoon. So, what, if anything, is the market telling us about the prospects for the upcoming Presidential Election?

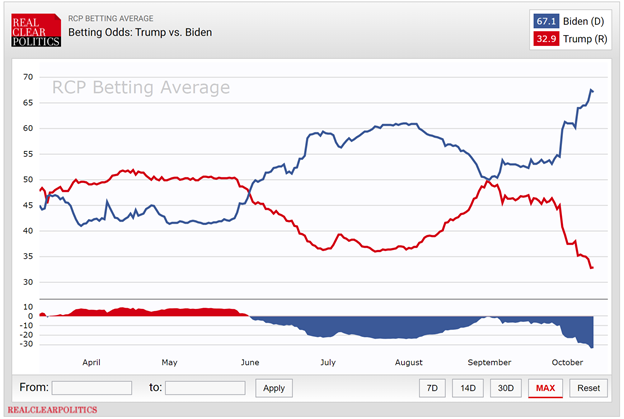

In our fall newsletter, I wrote that, without any states that Hillary Clinton won flipping, the election would come down to Michigan, Pennsylvania, and Wisconsin. Since I wrote that article, per Real Clear Politics, Joe Biden has widened his national lead to 8.9% from 7.8%. However, his leads in the three states I am highlighting have remained about the same. Currently, Biden leads in Michigan by 6.7%, Pennsylvania by 5.7%, and Wisconsin by 6.3%. Betting odds have now shifted dramatically in Biden’s favor with him at 67.1% and President Trump at 32.9%.

So, what gives? Well the market is telling us one of four things:

- The polls are wrong as they were in 2016 and President Trump is going to get re-elected.

- A Biden administration is not a bad thing for equities.

- The election does not matter and its impact on the economy/market is over-hyped.

- The market is hopped up on easy monetary policy and the potential for more fiscal stimulus.

I tend to believe the answer is a combination of the later three. In 2016, the final national lead for Hilary Clinton was 3.2%. She did win the popular vote, so the national polls were not that far off. It should be noted that then candidate Trump surged in the polls from June to the end of October, while Clinton fell in the polls beginning in mid-October. But it is important to remember that the popular vote is meaningless. The polls in Michigan, Wisconsin, and Pennsylvania did prove to be 5-6 points off and these states led to a Trump victory.

One other factor to consider, that no one is talking about, is the Gary Johnson factor. Johnson, the Libertarian candidate was polling between 4.6% and 6.1% in these three states. He ultimately took 3.6% in Michigan, 3.7% in Wisconsin, and 2.4% in Pennsylvania. Did his voters ultimately go for Donald Trump, the “non-establishment” candidate? This year Jo Jorgensen (Libertarian) is the only candidate that will be on the ballot in all 50 states. I have to admit, I thought Kanye West was the only other candidate running! There is a possibility that the polls are wrong, but adjustments have been made and they were closer in the 2018 mid-term elections. There is still some time to make up ground, but right now I believe that the market believes the polls.

This leads us to the other three things the market might be telling us. First, is the fact that a Biden administration might not be a bad thing for the equity markets and the economy. Goldman Sachs’ Chief Economist, Jan Hatzius predicts that a blue wave would be good for the economy. He points out that an increase in the corporate tax would be outweighed by larger fiscal stimulus and longer-term spending on infrastructure, climate, health care and education.

Next, maybe the effects of the election on the markets are overhyped. I have always said that Presidents get too much credit and too much blame for the economy. President Clinton was the benefactor of an economy that had strong population demographics, rising consumer debt, and a stock market with rising valuations. President Bush (second Bush) inherited a stock market bubble that burst, 9/11, and an early recession that he should not be blamed for. President Obama stepped in during the Financial Crisis. President Trump inherited a stable economy with declining unemployment rates.

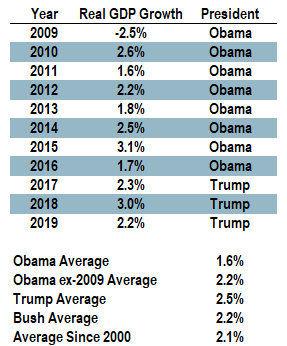

Since 2000, the economy has grown at an average of 2.1%. Under President Bush it grew 2.2% and under President Obama it grew 1.6%. However, to be fair to President Obama, he should not be credited with a -2.5% year in 2009. If you exclude 2009, the economy grew at an average rate of 2.2% under Obama. Some will argue that 2009 should not be excluded, but I am also going to be fair to President Trump and not blame him for Covid-19. A recession would have happened under any president. In the first three years of the Trump administration the economy grew at an average rate of 2.5%. However, it was slowing some going into 2020, and the pre-Covid estimates were around 1.8%. That would have put him at 2.3% for his four years. Overall, we see a similar growth rates across administrations this millennium and it should be noted that there is a litany of other things that drive the economy and markets.

The last thing the market could be telling us is that as long as we have easy money and the potential for fiscal and monetary stimulus, the markets will remain bullish. After the election, one way or another, things in Washington will thaw and if a second stimulus bill has not already passed, it will. That with the Fed on standby saying it will do whatever it takes, is likely the biggest reason the market is holding up at these levels.

If you are worried about the election and the implications on your retirement portfolio, the team at Element Wealth is happy to have a conversation with you. We believe there will likely be some noise in the markets surrounding the election. But that in the end, the potential for a large wave of Covid-19 cases in the winter pose a bigger risk in the short-term. However, as we get closer to a vaccine and increased immunity across the country, the possibility of a strong cyclical economic recovery in 2021, with lots of monetary and fiscal stimulus will be bullish. In the long-term there will be consequences to the debt, but that is a conversation for another day.

Stay safe and remember to go out and vote!

Jeremy Nelson, Partner

Element Wealth, LLC (EW) is an investment adviser registered with the Securities and Exchange Commission (SEC). EW only transacts business in states where it is registered, or where an exemption from registration is available. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC, nor does it indicate a particular level of skill or ability. Past performance is not indicative of future results, and investors should realize that investing in securities involves risk of loss. Money invested in securities is not guaranteed against such loss by any governmental or non-governmental organization. EW is not a law or accounting firm, and does not give legal, accounting or tax advice. More information about Element Wealth’s investment advisory services can be found in its Form ADV Part 2 as well as in Form CRS (Client Relationship Summary).