A couple of weeks ago I sat on a conference call hosted by PIMCO, one of the largest asset managers in the world. The call was a Q&A session with former Federal Reserve Chairman, Dr. Ben Bernanke. Chairman Bernanke was at the helm of the Federal Reserve during the Financial Crisis in 2008. With everything going on in the economy, markets, and the Feds response to it, I was very interested to hear what he had to say. Here is a summary:

Key Points

-

This crisis is different. The recession was not caused by the system or financial markets; therefore, the policy response needs to be different. In 2008, the Fed had to first address the banking sector and then support the economy. That is why you had the Troubled Asset Relief Program (TARP) first and then Quantitative Easing (QE). In 2020, it is about people’s health. So, getting money into the economy so people can pay bills is paramount.

-

Q2 QDP could be down 30% on an annualized basis. It will be a depression like number with the unemployment rate hitting levels higher than during the Financial Crisis. However, these numbers must be taken with a grain of salt.

-

The economic recovery will be correlated to the length of the recession, which will be determined by the public health care response.

-

Banks are strong but uncertainty is high so credit (bond) markets have been disrupted. The Fed has stepped in as the lender of last resort utilizing its power granted by section 13(3) of the Federal Reserve Act. Secured by the Treasury, they are backstopping credit markets by being a primary and secondary lender, launching a main street lending program, and purchasing investment grade and high yield corporate and municipal debt. It is important to remember that the Fed is a lender and not a grantor. Grants come from congress.

-

The dollar remains the most used currency for foreign reserves and settlement. Availability of dollars is critical so $350 billion from the Fed has been made available.

-

13(3) rules were tightened in the Dodd-Frank Act, but this Fed was able to act quickly as it could pull the terms from the Term Asset-Backed Securities Loan Facility (TALF) off the shelf. Also, stimulus has been easier to pass through congress, as there has been much less partisanship due to the fact that this is not viewed as a bank bailout.

-

What the Fed has done is a placeholder but has been quicker and more effective.

Expectations from the Fed

Looking forward, he expects bigger QE, strong forward guidance and for the Fed to remain easy. This is not surprising as prior to this crisis, Current chairman, Jerome Powell has indicated a willingness to let inflation run hot, in order to maintain growth.

Potential for Negative Interest Rates

The topic of negative interest rates came up. He noted that negative interest rates are not that unnatural. He used the example of a safe deposit box at the bank. If you keep physical cash locked up, you pay a fee to the bank for the safe deposit box, thus earning a negative yield. Also, cash always has a negative real (net of inflation) return. He does not expect to see rates go negative but if they did it would be limited in scope. First, the Fed has already said no, so it would take some backtracking. Second, if rates were to go too negative people would just hold cash. This would be bad for money market funds and banks.

Debt & Deficits

When asked about his thoughts on the amount of debt and deficits, I found his answers to be reserved but insightful. He was asked, how can we afford this? In the near-term the $2.2 trillion Cases Act is being completely funded in debt. (Personally, I would also note that this is on the back of running a trillion-dollar deficit while the unemployment rate was 3.5%. The 2020 federal deficit will be unlike anything we could have ever imagined.) This is necessary as we have to keep the economy alive like in WWII and 2008. He believes the actions taken have been appropriate. However, he pointed out that over the intermediate to long-term the budget needs to get under control. At some point we need better planning and legislators are not good at thinking 10+ years out. But today we have a high capacity for debt due to the demand for US treasuries.

Recovery Expectations

The shape and extent of the recovery will be determined by public health. Simply ordering the economy open will not work as people are scared. The process will be slow with false starts and different across industries. He does expect some recovery in the third quarter. He noted that he was unsure about the seasonality of the virus, but seasonality could lead to a ‘W’ shaped recovery.

Long-Run Expectations and Risks

The recession will be deep but short. This is not the depression. The depression lasted 12 years and was only ended by WWII. But there will be permanent capital impairment and risks that this leads to people become more cautious and thus spending less and saving more. There will likely be a change in the economic mix and the economy shifting towards big business over small business. This creates the potential for a loss of innovation. These factors point to lower interest rates for a long time.

What Was Not Said

As expected, Chairman Bernanke was somewhat reserved in his comments. However, he was much more open that he could have been as the Chairman of the Federal Reserve. During his tenure at the Fed he repeatedly said that monetary policy could only do so much and that it bought time for fiscal policy to catch up. On this call he clearly stated (in his own reserved manor) that congress needs to get the budget under control and begin to think longer-term. This leads me to one of the things that really worries me, the long-term debt cycle.

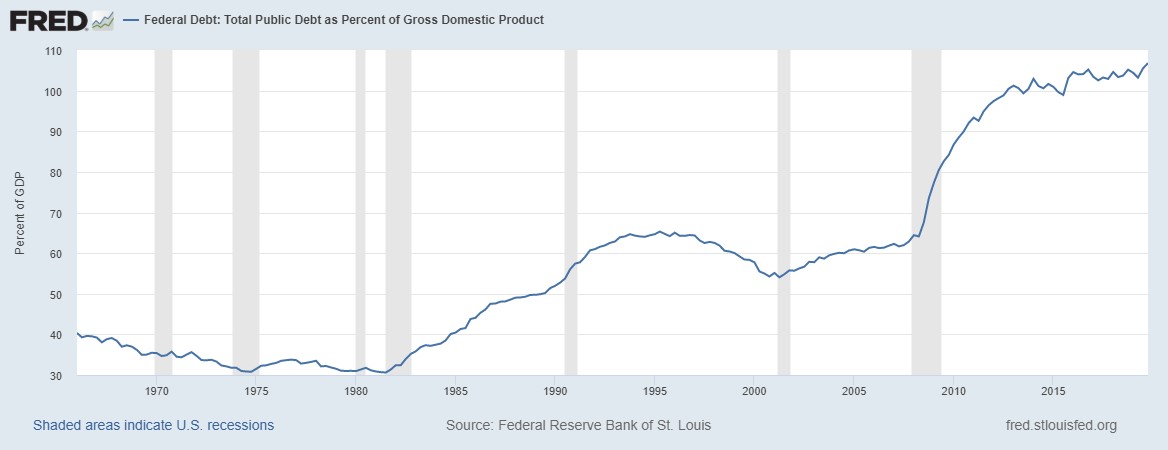

When WWII ended, we entered the US dollar-denominated world order. At that time, the dollar was backed by gold. Then in 1971, President Nixon announced that the dollar would no longer be tied to gold. Since then, we have seen the total public debt as a percentage of GDP go from approximately 35% to 107% at the end of 2019 (see chart below). With a recession and massive deficits in 2020, this will likely go over 120%. It should also be noted that this does not include the amount of US debt that has been monetized and sits on the Federal Reserve’s balance sheet.

I will not go into a long description of how debt cycles work. Instead, I will give you this link to a commentary by Ray Dalio. He describes it better than I, or anyone else can. The bottom line is, that what is happening, is unstainable and will need to change or change will be forced.

Understandably, I get a lot of questions about the federal debt. There is a lot of confusion as to how we can continue to accumulate it, and when it will matter. It is important to understand that we have been bailed out by low interest rates, which has made the debt more serviceable. This comes at the expense of savers who earn negative real interest rates on safe investments. There are also many countries who borrow in or peg their currencies to the dollar, thus creating demand.

I am still firmly in the camp that 2021 will see economic output get back close to 2019 levels. With an easy Fed and a recovering economy, stocks will likely do well and in 2021 or early 2022 hit new highs. But as we noted at our 2020 Economic and Market Forecast events, we believe a secular bear market will begin this decade. Investors should begin to build retirement plans that can respond to lower returns and increased volatility. The Covid-19 crisis and the debt accumulated in response to it has likely accelerated the need to prepare.

As always, we are here for questions. You can contact us here.

Stay safe,

Jeremy Nelson, Partner

Element Wealth, LLC (EW) is an investment adviser registered with the Securities and Exchange Commission (SEC). EW only transacts business in states where it is registered, or where an exemption from registration is available. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC, nor does it indicate a particular level of skill or ability. Past performance is not indicative of future results, and investors should realize that investing in securities involves risk of loss. Money invested in securities is not guaranteed against such loss by any governmental or non-governmental organization. EW is not a law or accounting firm, and does not give legal, accounting or tax advice.