A Wild Week

Mid-Term election weeks tend to bring some drama and excitement for the political landscape of the country and the financial markets. This past week was no different. The expected “red wave” did not materialize to the extent that many anticipated. It appears that the House will flip with a narrow majority for the Republicans and with 50 Senate seats and a runoff in Georgia, the Democrats will remain in control. There are still votes to count and the Georgia runoff, so this election cycle remains unfinished, but it’s safe to say that we should expect gridlock in Washington for the next two years.

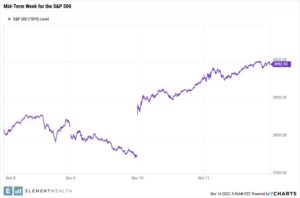

As important as the Mid-Terms were to the stock and bond markets, they were totally overshadowed by Thursday’s inflation report. After a minor sell-off on Wednesday with the fate of Congress in flux, the Bureau of Labor Statistics announced that the consumer price index (CPI) rose less than expected in October. A monthly increase of 0.4% and a year-over-year increase of 7.7% was less than the expected rise of 0.6% and 7.9% respectively.

News of a potential peak and subsequent cooling of inflation sent the stock market soaring on Thursday with some follow through on Friday. The 10-Year Treasury rate fell nearly 0.30% causing the Bloomberg US Aggregate Bond Index to rise nearly 2%.

Looking Forward

On a forward-looking basis we like to break things down into a short-term view, intermediate-term view, and a long-term view.

Our short-term view is largely driven by trading sentiment. In September and October our measures of trading sentiment showed the market was in a zone of extreme pessimism. So, it was not surprising to see a strong response from the markets to Thursday’s inflation number. However, rallies like this tend to give back a little. We would not be surprised to see a little pause and potential give back of some of last week’s gains.

On an intermediate-term basis we like to look at trends and the monetary environment. Currently, we see trends beginning to get better, and if inflation is slowing (we believe it is), it will give the Fed cover to become less hawkish. Seasonal forces such as the year-end (especially in Mid-Term years) and the third year of the Presidential Cycle (next year) are a positive. With this backdrop, we are cautiously optimistic but not outright bullish yet going into next year.

Our long-term view considers many more macro factors such as valuations, debt, demographics, government policy, and cycle analysis. This is where we raise some concerns. The S&P 500 is currently trading around 19 times earnings or has a P/E ratio of 19. The declines we have seen in stocks this year are not because corporate earnings are down. They are because we are paying less for the earnings, due to the higher interest rate environment. Going into the year the S&P 500 had a P/E Ratio of around 24. The change to a P/E Ratio of 19 reflects a 21% decrease in valuations.

Currently, we view the stock market as fairly valued, not cheap and not expensive. If we have a soft economic landing and do not have an economic and earnings recession, things will be alright. But if the monetary policy drives us into a recession, we will likely see more stress on equity markets later next year.

But for now, we view gridlock in Washington as a positive and will continue to watch for signs that inflation is subsiding. We expect the Fed to raise rates 0.50% at the next FOMC meeting and then begin to slow things down in 2023 as inflation continues to subside. For more information give us a call at (601) 957-6006 or e-mail public@myelementwealth.com.

Jeremy Nelson, Partner