Election Recap

November 3rd has passed. However, we still do not have a completely clear picture of what to expect out of Washington in 2021. As of this writing, President Trump has not conceded the election and continues to challenge the results in key swing states. Thus far, his legal team has not been successful, and we are moving ever closer to the certification of election results. At this point we believe former Vice President Biden will be inaugurated on January 20th.

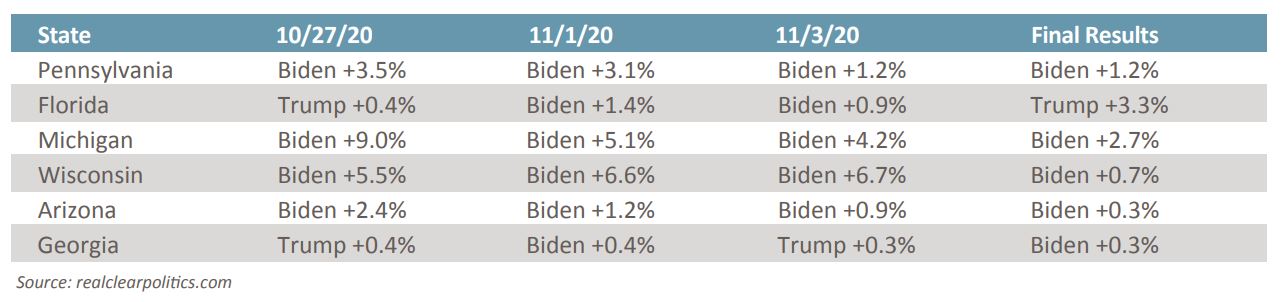

Polls generally shifted in President Trump’s favor over the final week before the election. Below are the Real Clear Politics averages for a few key swing states, beginning a week before the election through the final election results.

Averaging the polls out proved to be moderately better in 2020 compared to 2016, but there were some significant misses. President Trump easily won Florida where he was down slightly. In Michigan, election results proved to be much closer than thought, although it should be noted that the polls tightened significantly over the final week. Wisconsin election results were outside the margin of error, proving to be 6.0% off. Georgia and Arizona showed a tight race in the polls and the eventual margins were razor thin. Within the six states listed above, only one poll was withing 0.5% of the actual results, the NBC News/Marist final poll in Arizona showed a tie. This is the reason why we never believe a single poll. We should use the average of the polls, and even then, take them with a grain of salt.

As an aside, our belief that Vice President Biden will be inaugurated is not a reflection of my views, or our firm’s views, on the validity, or lack of validity, on the claims of election fraud that are currently playing out in the courts and the media. We simply believe that it is the most likely outcome.

What’s Next?

In our Fall Newsletter, I ended my commentary by saying, “Assuming a Biden victory, which is no guarantee, it appears that what happens down ballot in the Senate could be the bigger story as it would either give the Democrats full reign or maintain the checks and balances of a divided government.” With two runoff elections in Georgia on January 5th, the fate of the Senate is up for grabs. Republicans currently have a 50-48 seat advantage. If they can hold at least one seat, they can effectively block any major legislative changes. If they do not, the presumable Vice President-Elect, Kamala Harris, would have any tie-breaker vote. Polls are currently close in both races, so we are keenly awaiting the results.

At this point we believe the market is expecting a divided Congress. If it begins to look like that will not be the case, we expect a minor sell-off in the equity markets. But the story for the next couple of months will be COVID-19. Equity markets rallied into and through the initial days after the election. Then on Monday, November 9th, Pfizer released early analysis showing its COVID-19 vaccine is more than 90% effective. Moderna released similar results a few days later. With the Presidential election behind us and COVID-19 vaccines just around the corner, investor optimism has risen. But has the market come too far too fast?

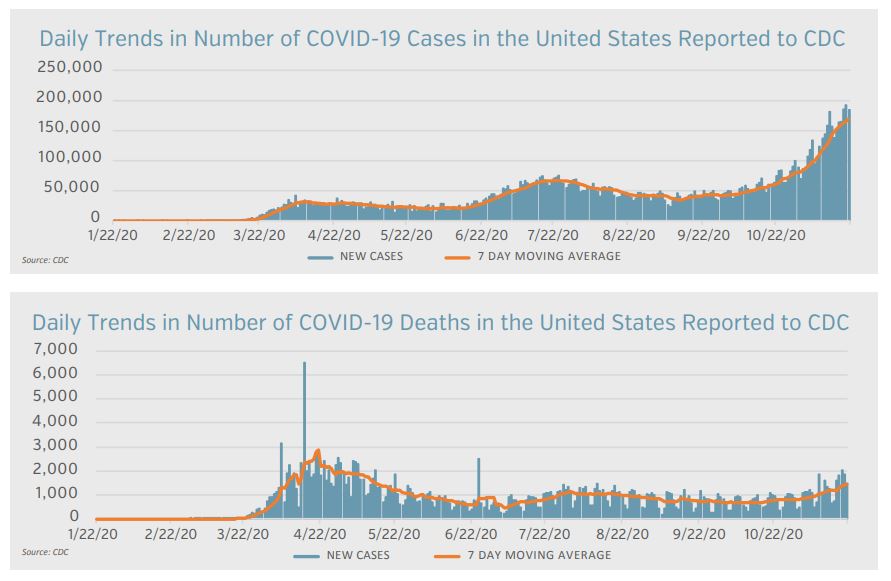

Case counts are rising at an alarming rate. Fortunately, COVID-19 related deaths are not rising at the same rate. This is due to a better understanding of how to treat the virus and a higher percentage of lower-risk individuals contracting it. With vaccines on the horizon, there is some light at the end of the tunnel; however, the risk of increased prevention measures, such as limitations on businesses or lockdowns in extreme cases, is rising. Ultimately, the virus situation will get worse before it will get better.

With all that has happened over the past month, we believe that market sentiment is a little extreme. The runoff elections in Georgia and COVID-19 cases are two things that could drive volatility over the last few weeks of the year. That being said, our outlook for 2021 is good. COVID-19 vaccines, more fiscal stimulus, and an accommodative Fed set the backdrop for a continuation of the strong economic recovery.

In the coming weeks we will be releasing our full 2021 outlook. In the meantime, enjoy the holiday season and stay safe.