There are a lot of risks that can derail your retirement. So, over the next few weeks Element Wealth will be releasing a series of informational e-mails that will help you understand each risk and potential solutions to combat them. There are no silver bullets to address your retirement needs (no matter what the people hocking products or services on the radio, television and social media say). However, we believe that using a framework of balancing an individualized mix of income, growth, and guarantees can give you the peace of mind you’re looking for.

Just before the Coronavirus outbreak, I did an interview with Scott Drake from Retirement News Online (click here to see the interview). The topic was Sequence of Returns Risk. Simplistically put, this is the risk that you retire and get hit with a bear market early in the first few years.

Think about retiring in 2000 or 2007. You’ve worked your entire career; the economy is good, and the markets are at all-time highs. Then boom! The broad equity markets proceed to decline 50% or more, and on top of that, you have now taken money out to live on. Surely you were diversified and not 100% invested in stocks, but your portfolio still has taken a hit. Since you took money out, you have less money invested for the recovery. In fact, it took the market multiple years to recover so you’ve likely been forced to take at least two- or three-years’ worth of distributions with prices below where you started.

As I’ve stated in my previous communications, I am optimistic that the economy and markets will recover from the recent crisis. The Federal Government and Federal Reserve have taken unprecedented actions to support individuals, small businesses, and large businesses. However, there are some potential long-term ramifications.

This morning I had the opportunity to sit in on a conference call put on by PIMCO (one of the world’s premier asset managers). They interviewed former Federal Reserve Chairman, Ben Bernanke. I will do a separate commentary to go over his comments, but he did say there is potential that, like after the depression, people become cautious and save more money. With an economy that is almost 70% consumption based, that could have a significant impact. Also, the government response has been completely funded in debt. Currently, financing costs are low and there is a lot of demand for U.S. treasury securities. But over the longer-term, we will have to find a way to pay for the government outflows and get the budget deficit under control. My interpretation is that future tax rates could be higher.

In our 2020 Economic & Market Forecast, we outline our “Themes for the Next Decade.” One of those themes was the start of a new secular bear market. This does not mean doom. It simply means that we could enter an extended period with below average, or negative real (net of inflation) returns for stocks. As my partner, Barry Smith, likes to say, “in a secular bear market you get on a roller coaster and end right back where you started.” Although that is not exactly the case every time, I like the analogy.

Right now I am not convinced that this is the beginning of the secular bear market. We are in the midst of a recession that could see an annualized GDP decline of 30% in the second quarter. Yet, the S&P 500 has rushed back to just 16% off the all-time highs. When the decline began, most market commentators agreed that the market was overvalued. Based on that view, we are only about 6-10% below what was considered fair value for the S&P 500.

I take three things from this:

- With the 10-year Treasury below 1%, there is a lot of demand for stocks. It’s the TINA There Is No Alternative. This will fuel stocks post crisis.

- We could be susceptible to a pullback in the coming days or weeks when selling pressure comes back.

- The worst is likely behind us.

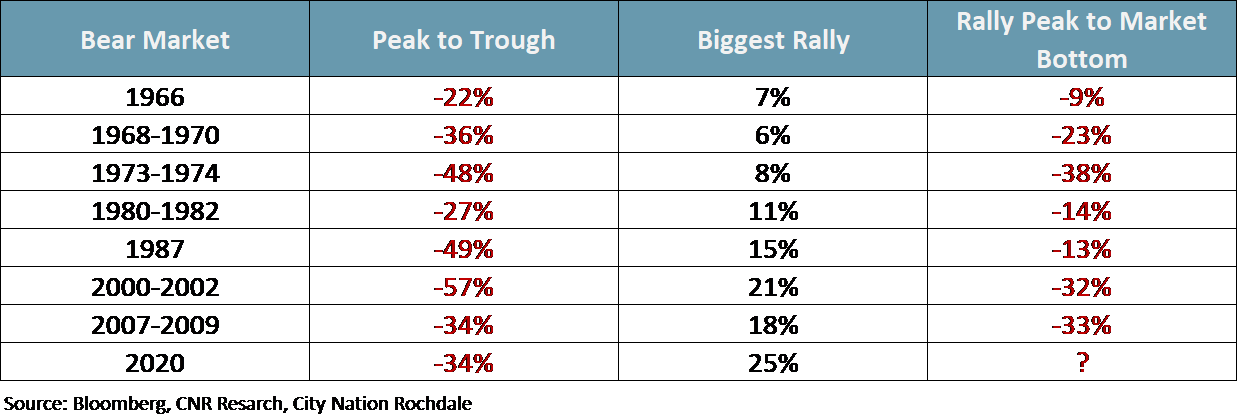

In 1966, 1968-1970, 1973-1974, 1980-1982, 1987, 2000-2002, and 2007-2009 we had bear markets. In each of these cases after the initial declines there was a rally followed by subsequent decline.

What will happen for the rest of 2020 is unknown. We all know that past performance is not a guarantee of future results and history does not always repeat itself, although it often rhymes. Considering that your social calendar is currently empty, I highly recommend that you take some time to look at your retirement plan. If you need some help, we are here for you.

As always, the team at Element Wealth wishes you well during these turbulent times.

Jeremy Nelson, Partner

Be sure to follow us on Facebook and LinkedIn!

Element Wealth, LLC (EW) is an investment adviser registered with the Securities and Exchange Commission (SEC). EW only transacts business in states where it is registered, or where an exemption from registration is available. Registration as an investment adviser does not constitute an endorsement of the firm by the SEC, nor does it indicate a particular level of skill or ability. Past performance is not indicative of future results, and investors should realize that investing in securities involves risk of loss. Money invested in securities is not guaranteed against such loss by any governmental or non-governmental organization. EW is not a law or accounting firm, and does not give legal, accounting or tax advice.